Summary

- The immediate impact of China’s reopening is a rapidly increased demand from the largest consumer market and the second largest importer, and this will effectively support global demand and boost global economic growth in the short run

The Covid-19 pandemic was mostly seen as a demand shock when it just started, then people realized that its impacts on the supply side are far more severe and persistent. As the pandemic unfolded and the Russian-Ukraine conflict broke out, supply chain disruption, labor constraints and energy shortage grew in breadth and intensity, impacting the ability of firms to meet the strong surge in demand and pushing up inflation. Central banks across the world simultaneously raised interest rates in response to severe inflation. As global inflation slowly entered a downward trend after peaking in late 2022 and European natural gas prices dropped to pre-conflict levels, weak and divergent recovery, or worse, the recession in many countries gradually took priority and became the main concern in 2023.

China’s reopening could be this year’s biggest economic event. A consensus is immediately reached that this reopening will boost China’s economy, but what does it mean to the world economy? Most are optimistic. Some express concerns that increased demand, especially for energy, could add to global inflation pressure. The energy shortage due to the Russian-Ukraine conflict further disrupted the slow recovery raising fears of high energy prices that could trigger high inflation. However, abundant research has shown these concerns have been overstated, and energy prices have limited and short-lived impacts on inflation. For example, a recent World Bank cross-country study found that oil prices accounted for about 4 percent of inflation variation. Despite these concerns, most believe China’s reopening will help lift the global economy. In its World Economic Situation and Prospects 2023 report, the United Nations predicts that the Chinese economy will “support growth across the region.”

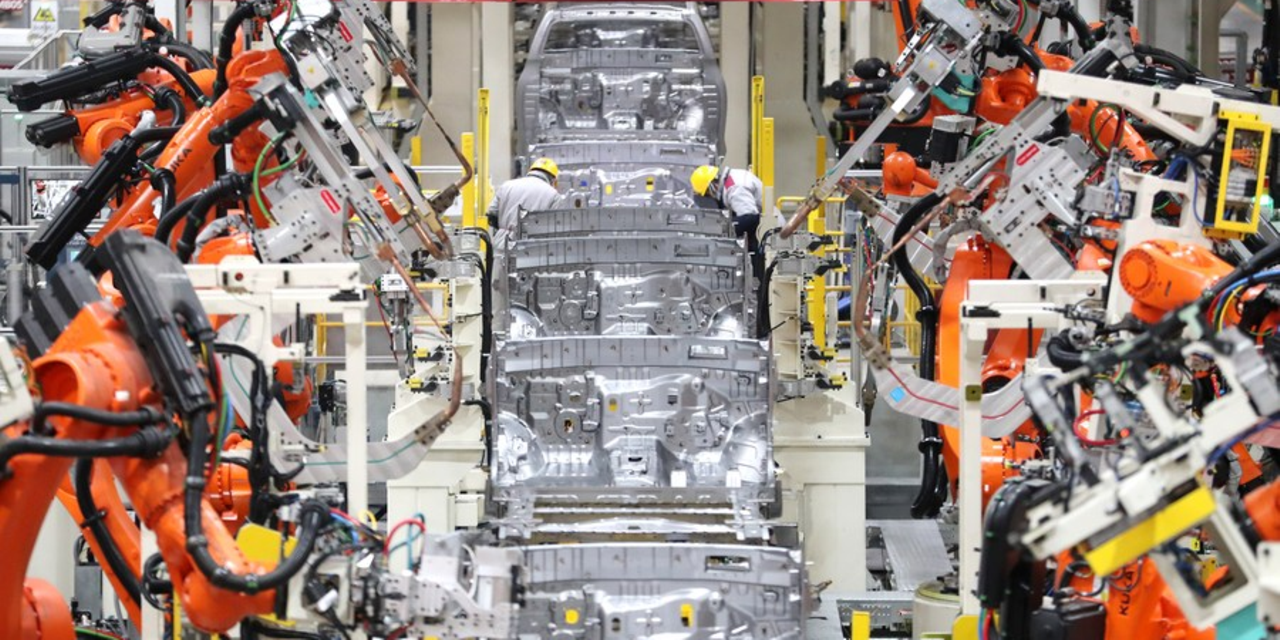

The immediate impact of China’s reopening is a rapidly increased demand from the largest consumer market and the second largest importer, and this will effectively support global demand and boost global economic growth in the short run. With warmer consumer confidence following the clear and positive policy signals, the pent-up demand due to the pandemic is released and the economy is expected to see a significant increase in consumption. For the domestic sector, investment activities and employment will increase rapidly alongside rising consumption, which will in turn stimulate production. For the global economy, exporters of goods and services, popular destinations for Chinese tourists, and even popular study-abroad countries for Chinese students will benefit. More importantly, an increase in an economy’s aggregate demand will promote its labor market, and higher employment and household income could further increase its domestic demand, resulting in a more sustainable and resilient economic recovery. Generally speaking, increased demand could be a factor in raising the commodity price level, however, the current inflationary pressure is dominated by the supply side. The post-pandemic inflation was driven by many factors. In addition to the aggressive expansionary policies previously implemented worldwide, the impacts of labor shortage, shipping bottlenecks, and supply chain disruption on inflation were much more severe. There are too few policy instruments for too many goals, and frankly speaking, many countries have already exhausted their policy spaces. As discussed in a recent World Bank report, the current policy actions may not be sufficient to bring global inflation back down to its pre-pandemic level. China could be a major engine lifting global economic growth and cooling global inflation. Aside from supporting global demand, another major impact of China’s reopening would be to help restore the global supply chain. With work and production resumed, China’s domestic logistics and supply chain have been recovering quickly and the economy is returning to its normal pace.

As one of the world’s largest exporters, China’s reopening could directly ease the world supply shortage, especially for manufactured goods and integrated circuits. The intermediate goods such as integrated circuits would further stimulate downstream sectors, such as the electronic products industry and the automotive industry. In addition, global supply chain disruption could be further eased by more efficient global factor markets. Following the global supply chain being restored and the gap between demand and supply being closed up, inflation is expected to return to its normal level.

By An Zidong